Make Your Dreams

Come True

Ready to start a new life in a new place?

Let's Get Started

about us

We’re passionate about our people – our clients, our employees, and our partners.

- What We Do

- Who We Are

- Social Impact

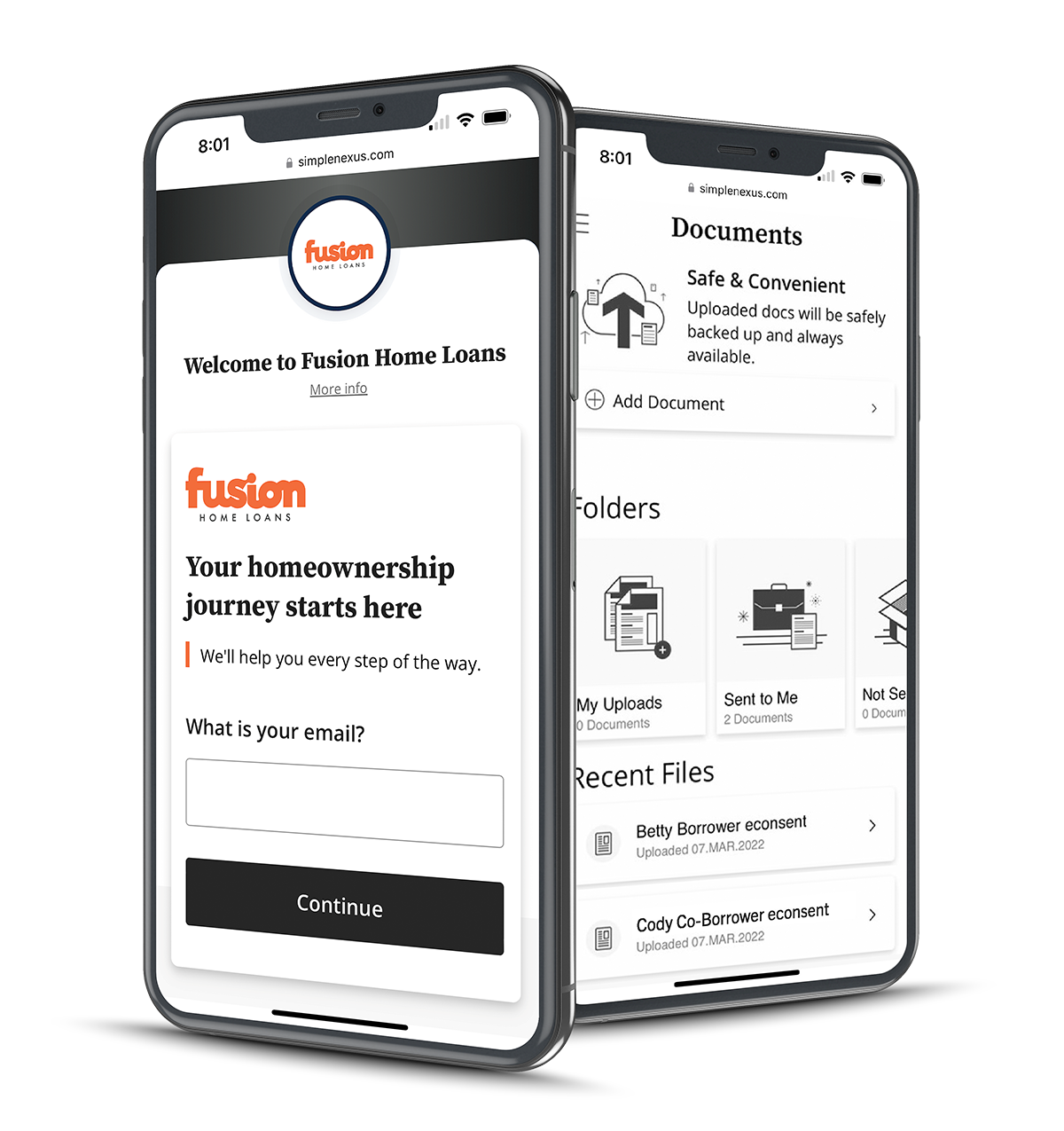

We combine award-winning teamwork with industry-leading technology to provide a smooth and seamless loan process, working together to provide top-tier home financing to our clients.

We are a team of experienced mortgage professionals across the nation committed to delivering exceptional customer service and providing a personalized approach to fit our client’s needs.

calculator

My Monthly Payment

what people say

See why our clients would recommend us to friends and family.

Eddie S.

Victoria W.

Juwan B.

Shawn K.

Melanie M.

Jesi R.

our blog

Learn More About Mortgages

Emergency Preparedness Tips For Your Family

Whether you live on the coast, in the plains, or near fire-prone areas, having an emergency preparedness plan can help provide peace of mind and ensure you can act quickly when needed.

Maximizing Your Home Equity

Homeownership comes with many advantages. Explore three ways to maximize your home equity: Home Equity Line of Credit (HELOC), Home Equity Loan (HELOAN), and Cash-Out Refinance.

Understanding Down Payment Assistance Programs

Down Payment Assistance (DPA) programs offer significant benefits to homebuyers and can be the key to building wealth through homeownership, while keeping savings intact for future expenses.

We pride ourselves on being a valuable partner in the communities we serve by supporting local charitable organizations with both in-kind and monetary donations.